In 2025, accounting continues to be one of the most in-demand and stable career paths for those seeking permanent residency (PR) in Australia. With growing business needs, regulatory changes, and a shortage of skilled professionals, accountants remain on the Medium and Long-term Strategic Skills List (MLTSSL), making them eligible for general skilled migration programs.

Whether you're a recent graduate or an experienced professional, understanding the PR for accountants in Australia is essential. This guide will walk you through eligibility, qualified occupations, application steps, and pathways specifically designed for accountants in Australia.

Eligibility Requirements for Accountants Seeking PR in Australia

To be eligible for PR for accountants in Australia, applicants must meet the following criteria:

Educational Qualifications: A Bachelor's degree in accounting or a closely related field equivalent to an Australian bachelor's degree.

Skills Assessment: Obtain a positive skills assessment from one of the recognized assessment authorities:

- CPA Australia

- Chartered Accountants Australia and New Zealand (CA ANZ)

- or the Institute of Public Accountants (IPA).

English Language Proficiency: Provide English test scores (IELTS, PTE Academic, TOEFL) meeting minimum standards, usually IELTS 7.0 or equivalent.

Points Test: Achieve a minimum of 65 points on the General Skilled Migration (GSM) points test through factors such as age, English proficiency, work experience, and education.

Meet Health & Character Requirements

Complete medical checks and provide police clearance certificates.

Popular Visa Options for PR for Accountants in Australia 2025

When applying for permanent residency for accountants in Australia, there are several skilled migration Australia accountant visa options to consider. Let’s find out.

1. Subclass 189 – Skilled Independent Visa

This visa is a points-tested, permanent residency visa that does not require sponsorship or state nomination. You can live anywhere in Australia permanently. It is ideal for applicants with a high points score.

2. Subclass 190 – Skilled Nominated Visa

The Subclass 190 visa requires nomination by an Australian state or territory government. In return for the nomination, you receive an additional 5 points towards your migration points test. However, you must commit to living and working in the nominating state or territory for a specified period & get permanent residency as an accountant in Australia upon approval.

3. Subclass 491 – Skilled Work Regional (Provisional) Visa

This is a provisional visa designed for skilled workers willing to live and work in regional Australia. It requires either nomination by a state or territory government or sponsorship by a family member residing in a designated regional area. The Subclass 491 visa grants an extra 15 points on the points test. After living and working in regional Australia for at least 3 years, visa holders can apply for permanent residency under Subclass 191.

Read More: How to Improve PR points in Australia

How to Apply for PR as an Accountant in Australia?

Step | Action | Details |

1. Skills Assessment | Apply through CPA Australia, CA ANZ, or IPA | Must hold a Bachelor's or higher accounting degree, PR eligibility Australia. It also includes 1 year of relevant work experience if applying offshore. |

2. English Language Test | Take IELTS, PTE, or TOEFL | A strong performance is required in each section of the test to meet eligibility. |

3. Submit EOI | Create EOI on SkillSelect | Choose visa subclass 189 (Independent), 190 (State Nominated), or 491 (Regional). Minimum 65 points recommended. |

4. State Nomination (if needed) | Apply for 190 or 491 nomination | Ensure the occupation is listed in the relevant state's occupation list. May require a residence or accounting job offer in Australia. |

5. Visa Application | Lodge a visa via the Home Affairs portal | Submit all required documents, including ID, assessment, test scores, work history, health & police checks. Avoid Visa Rejections in Australia by ensuring everything is correct. |

6. Await Outcome | Processing time: 6–12 months | You may be contacted for additional documents. A PR grant notice will be issued upon approval. |

Which Accounting Jobs in Australia qualify for PR?

Here are some of the popular accounting jobs in Australia, along with ANZSCO codes for accountants:

1. Accountant (General) – ANZSCO 221111

Handles financial statements, audits, and advisory services.

Education & Skills: Bachelor’s in Accounting; strong analytical, reporting, and compliance skills.

2. Management Accountant – ANZSCO 221112

Focuses on budgeting, cost control, and financial strategy.

Education & Skills: For a finance & Accounting degree, PR eligibility in Australia requires skills in cost analysis, forecasting, and decision-making.

3. Taxation Accountant – ANZSCO 221113

Handles tax returns, planning, and compliance with laws.

Education & Skills: Accounting degree, PR eligibility in Australia with tax electives; strong knowledge of Australian tax laws and attention to detail.

4. External Auditor – ANZSCO 221213

Reviews financial reports for legal and policy compliance.

Education & Skills: Degree in Accounting; auditing experience and familiarity with international auditing standards.

5. Internal Auditor – ANZSCO 221214

Evaluates internal systems, risk controls, and operations.

Education & Skills: Degree in Accounting or Business; expertise in internal processes, governance, and risk management.

Read More: How Do You Get Australian Permanent Residency?

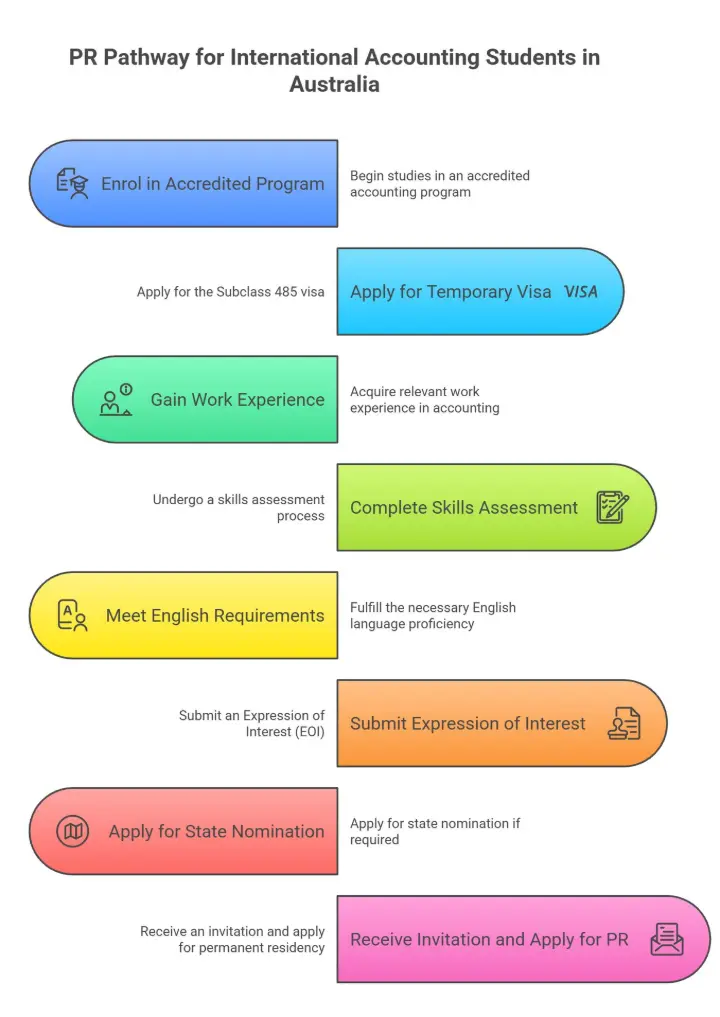

PR Pathway for International Accounting Students in Australia

1. Enrol in an Accredited Accounting Program

Choose a CRICOS-registered university or institute offering PR Pathway Courses in Australia that offers a Bachelor’s or Master’s degree in Accounting. Ensure the program is recognized by CPA Australia, CA ANZ, or IPA for future skills assessment.

2. Apply for Temporary Graduate Visa (Subclass 485)

After completing your accounting degree with PR eligibility in Australia, apply for the Post-Study Work Stream of Subclass 485. This visa gives you 2–4 years of full work rights in Australia, depending on your qualification level and study location.

3. Gain Relevant Work Experience in Accounting

Work full-time in roles related to your qualification (e.g., tax, audit, general accounting). Some skills assessments (especially offshore) may require at least 1 year of relevant experience.

4. Complete a Skills Assessment

Apply through CPA Australia, CA ANZ, or IPA for a skills assessment. You must meet academic and, in some cases, work experience requirements to receive a positive result.

5. Meet English Language Requirements

Take IELTS (7.0 in each band), PTE (65 in each), or TOEFL iBT (Reading 23, Writing 24, Listening 24, Speaking 27). Test results must be valid at the time of application.

6. Submit an Expression of Interest (EOI)

Use SkillSelect to lodge your EOI, selecting visa subclasses like 189, 190, or 491. A minimum of 65 points is required — more points improve your chance of invitation.

7. Apply for State Nomination (if needed)

If applying for Subclass 190 or 491, check the specific requirements of the states or territories. Some may prefer applicants already living or working in their region.

8. Receive Invitation and Apply for PR for accountants in Australia

Once invited, submit your visa application with supporting documents (skills assessment, EOI, police clearance, health check).

To Wrap it All!

In 2025, accounting continues to be one of the strongest and most reliable pathways to permanent residency in Australia. With the MLTSSL list 2025, accountants have multiple roles and steady demand for accountants in Australia across sectors, skilled professionals and international graduates have a clear advantage.

The process might feel overwhelming at first—skills assessments, English tests, EOIs—but when you take it step by step, it becomes much more manageable. And remember, you don’t have to do it alone. There are resources, support, and experts available to help you along the way.

If you are looking for a professional & experienced Immigration agent in Adelaide who can help you simplify the process, then VisaFast Migration Consultancy can help.

To know more about us, how the process works & how we can help you, book a consultation call with us today. Your future as a permanent resident in Australia might be closer than you think.

Frequently Asked Questions(FAQs)

Can I get PR in Australia with an accounting degree in 2025?

Yes. You must complete an accredited accounting program, achieve a positive skills assessment from CPA Australia, CA ANZ, or IPA, meet English language requirements (IELTS 7.0 in each band or equivalent), and score at least 65 points under the General Skilled Migration (GSM) system.

Is accounting still on the skilled occupation list in 2025?

Yes. In 2025, multiple accounting roles remain listed on the Medium and Long-term Strategic Skills List (MLTSSL), which makes them eligible for Subclass 189 (Independent), 190 (State Sponsored), and 491 (Regional Sponsored) visas.

How to get a PR in Australia after a master's in accounting?

- Graduate from a CRICOS-registered Master’s in Accounting.

- Apply for the Subclass 485 (Temporary Graduate) visa.

- Gain relevant work experience.

- Obtain a positive skills assessment.

- Meet the English requirement.

- Submit an Expression of Interest (EOI).

- Receive an invitation and apply for a PR visa (189/190/491).

Which accounting specializations are in demand in Australia?

In 2025, demand for accountants in Australia is high for:

- Taxation Accountants – due to complex business and personal tax laws.

- Management Accountants – for strategic cost control and planning.

- Auditors (Internal & External) – for risk management and compliance.

- Forensic and Financial Compliance Accountants – especially in government and corporate sectors.

What is the ANZSCO code for accountants applying for PR in Australia?

Here are the main ANZSCO codes for accountants on the MLTSSL list 2025 accountants in 2025:

- 221111 – Accountant (General)

- 221112 – Management Accountant

- 221113 – Taxation Accountant

- 221213 – External Auditor

- 221214 – Internal Auditor

Disclaimer: This article is for general information purposes only and does not constitute legal or immigration advice. Immigration laws and policies may change over time, so we strongly recommend consulting a registered migration agent or legal professional before making any visa application.